AAVE, which means “ghost” in Finnish, is a decentralized finance (DeFi) protocol that allows people to borrow and lend cryptocurrencies or tokens using smart contracts. By replacing intermediaries such as banks and exchanges, AAVE enhances affordability and efficiency. The protocol operates on the Ethereum blockchain and supports various tokens.

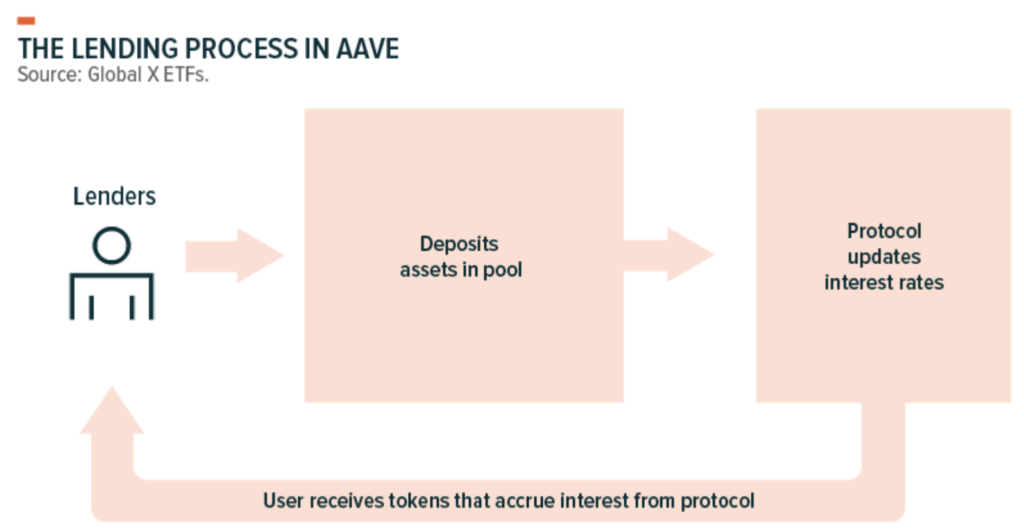

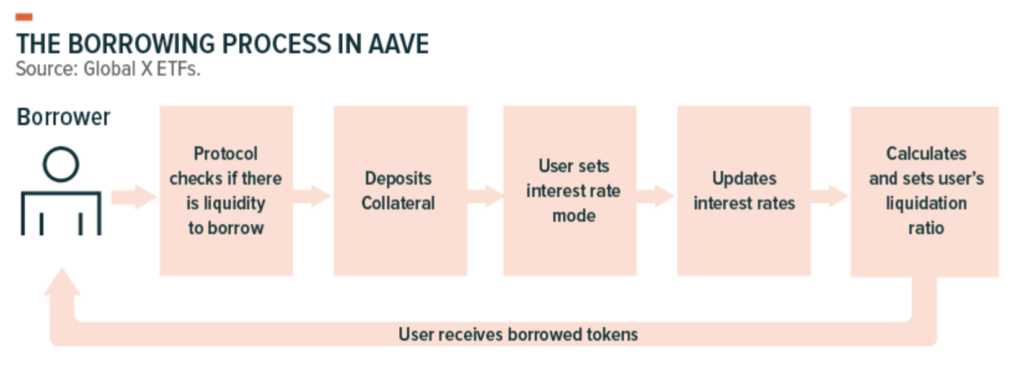

Lending Mechanism:

Instead of directly connecting lenders and borrowers, AAVE utilizes a peer-to-smart contract system. Lenders deposit assets into a smart contract and earn interest on their deposits, while borrowers provide collateral and pay interest to the contract. Borrowers must be over-collateralized, meaning they need to deposit more collateral than the value they wish to borrow. If the value of the collateral falls below a certain threshold, the borrower is subject to liquidation to repay the loan.

Interest rates on AAVE are algorithmically set and vary by liquidity pool based on the availability of assets. For instance, if AAVE has a low supply of Ethereum, it raises interest rates to attract more ETH deposits from lenders. Oppositely, if there are plenty of ETH, the protocol will lower interest rates to incentivize borrowing.

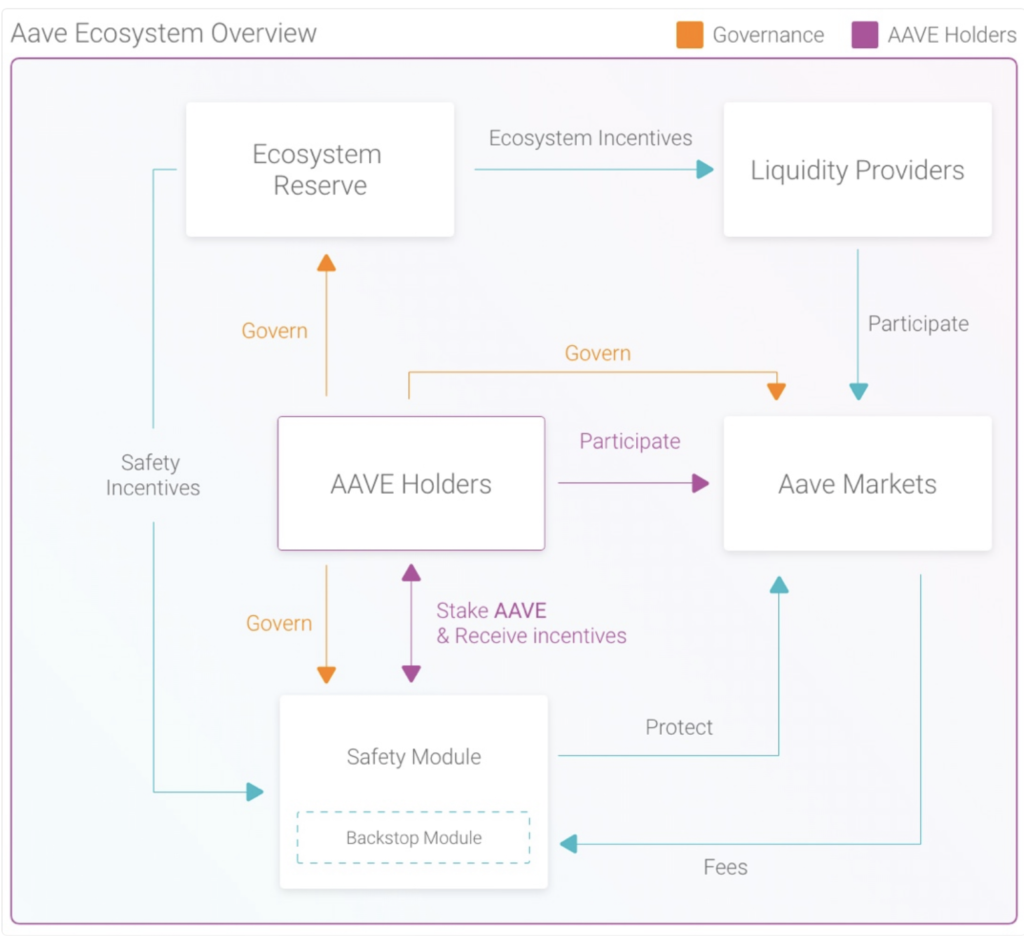

AAVE also includes a built-in security feature called the Safety Module, where AAVE tokens are used to compensate for bad debt in rare cases. For example, when liquidating low-liquidity tokens, significant slippage may result in insufficient funds to cover the debt. In such situations, AAVE tokens from the Safety Module, which consists of both staked tokens and a spread from borrowing activities, can be used to cover the deficit.

Flash Loans:

Users can access large uncollateralized loans using Flash Loans, but they must return the loans plus fees within the same block, typically in a few seconds. Flash loans are usually utilized for specific tasks via smart contracts, such as trading arbitrage, collateral swaps, or self-liquidation. Specifically, trading arbitrage involves buying an asset at a low price and selling it at a higher price, often in different markets. Due to the competitive nature of arbitrage, markets have become more efficient.

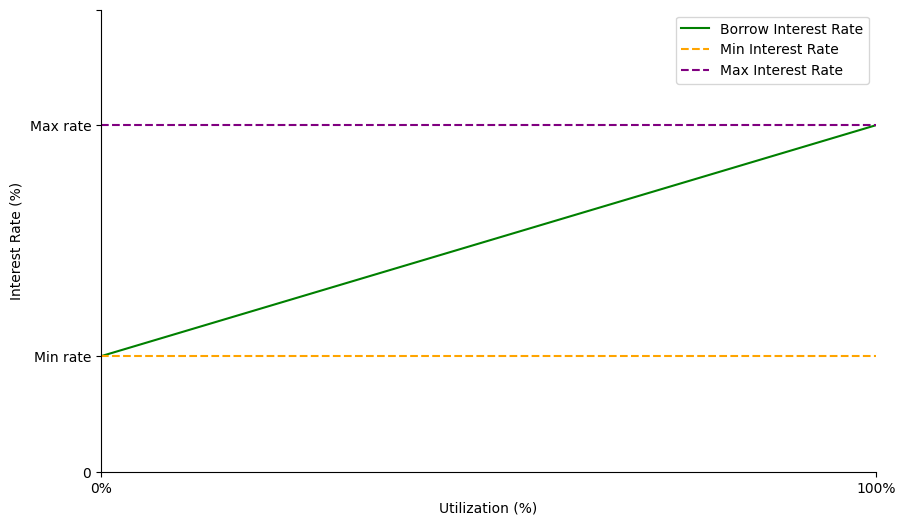

Rate Algorithm:

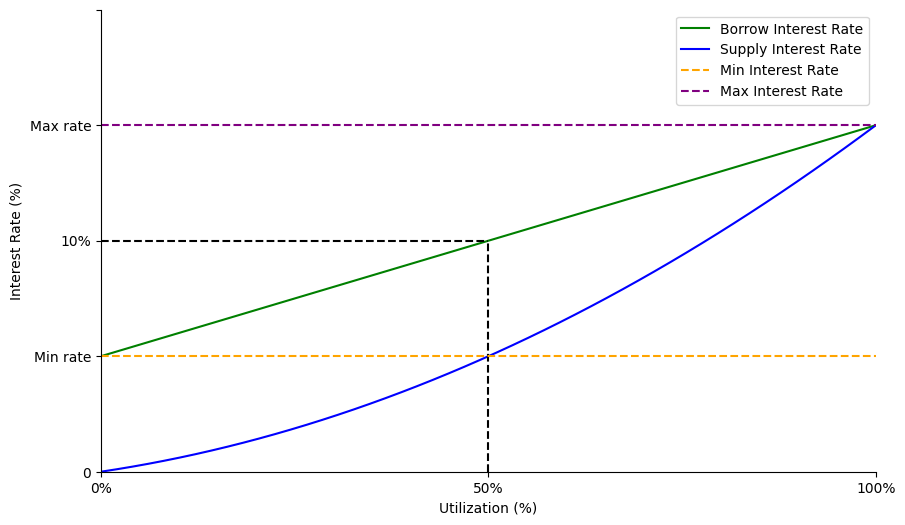

In a simplified model, the supply rate is determined by the borrow rate, which in turn is based on utilization, driven by borrow demand. Utilization is mathematically defined as:

Utilization = Assets Borrowed / Total Deposits

As borrow demand increases, utilization rises, and this influences the borrow rates. There are upper and lower boundaries to ensure that the rates remain within a specified range.

Additionally, the supply rate is determined by the following equation:

Supply Rate = Borrow Rate * Utilization

The graph below illustrates this relationship.

There are more sophistic calculations such as spread, but I will leave algorithm for another research in the future.

Conclusion:

The business model of AAVE seems to be sustainable, given that there is real demand for AAVE tokens and the protocol has accounted for liquidity risk. Furthermore, AAVE holders can participate in the decision-making process of the protocol. This includes decisions on new assets, adjusting pool parameters, setting platform fees, and upgrading the platform, which make sure the protocol is moving in the right direction. However, there is still risk that the smart contract can be attacked or fail, not only for AAVE, but for all DEXs. A further research can be on algorithm, particularly whether the it provides the most competitive rates and highlights the advantages of a DEX compared to a centralized exchange (CEX).